The Ultimate Guide to Saving on Car Insurance

Car insurance can be one of the most significant expenses in your budget, especially if you own multiple cars. Many factors determine your insurance costs: where you live, how often you drive, your driving purpose (work-related or personal), your driving history, your credit history, the type of car you drive, and more.However, you cannot go without insurance. If you drive, you must have insurance. Otherwise, you risk fines or even losing your license. Not to mention, if you’re involved in an accident, you’ll be responsible for the expenses. Car insurance is essential.

If you’re ready to start saving on car insurance costs, you’ve come to the right place. There are several ways to lower this expense, beginning with the following two quick options:

Quick Ways to Reduce Monthly Car Insurance Costs

Raise Your Deductible to Lower Insurance Costs

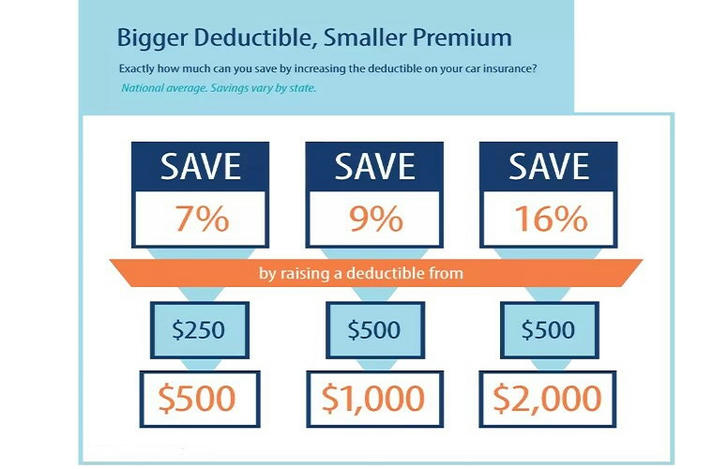

Increasing your deductible means you’ll pay more out-of-pocket if you’re in an accident, but it usually results in a lower monthly premium. This can save you a significant amount of money over time. For instance:

• If your current deductible is $250, increase it to $500.

• If your current deductible is $500, raise it to $1,000.

Just ensure that your emergency fund can cover the deductible amount in case of an accident. For minor collisions, consider paying out-of-pocket to avoid increasing your insurance premiums. Most small incidents will already fall within the deductible amount. Before filing a claim, always get an estimate first.

Ask About Discount Options

Another effective way to reduce your insurance premium is by inquiring about special discounts. Many insurance companies offer reductions for:

• Good students or military members.

• A clean driving record without accidents.

• Cars equipped with safety features like ABS brakes or anti-theft systems.

Some discounts may be less well-known. For example, professional associations often provide their members with access to special discount codes for car insurance. List all memberships you hold—networking groups, online organizations, even alumni associations—and contact your insurance company to check if any of these groups offer negotiated discounts.

It’s worth calling your insurance company directly instead of relying solely on email or online chat. Discuss any discounts you may qualify for; you might be surprised by what you find.

Greater Savings – More Research & Preparation Required

While these two options can quickly reduce your insurance costs, saving a significant amount of money may require additional research and preparation. Investing time in exploring your choices can pay off when you make substantial savings.

Are You Paying Too Much for Insurance?

First, ensure you have the right amount of insurance coverage to meet your needs. Insurance companies profit by encouraging policyholders to carry as much insurance as possible, but that doesn’t always mean you need the highest level of coverage.

Many accidents are minor fender benders, and over-insuring yourself can lead to paying for unnecessary protection.

Here are the most common types of car insurance to assess if you’re overpaying:

Types of Insurance and Their Purposes

1.Liability Insurance

This pays for damages you’re responsible for but does not cover injury to you or passengers in your car.

2.Bodily Injury Liability (BIL)

Covers the medical expenses of injured parties if the accident was your fault. Typically described as 20/50 or 100/300:

A 20/50 policy will pay a maximum of $20,000 per person injured and $50,000 total for all injured parties.

3.Property Damage Liability

If you’re at fault in an accident, this covers damages to another vehicle. For example:

A 20/50/10 policy will pay $20,000 for a single injured party, $50,000 for all parties, and $10,000 for damages to another vehicle.

Note: Be mindful that if costs exceed your insurance coverage, you’ll still need to pay out-of-pocket. Ensure your insurance coverage meets or exceeds your total assets, including your home, car, savings, and investments.

4.Personal Injury Protection (PIP)

Covers medical expenses for you and your passengers after an accident, even if you’re at fault. This can include lost wages if the injuries cause you to miss work. If you already have sufficient health and disability insurance, you might not need much PIP. However, if you lack these, increasing your PIP could save you from significant out-of-pocket medical costs.

5.Uninsured/Underinsured Motorist Insurance

Protects you if another driver causes an accident but lacks sufficient insurance. Most states require this coverage, and it’s typically affordable. It helps cover medical expenses your health insurance may not pay.

6.Collision Insurance

Covers your car's repair costs after an accident. Costs can vary based on the type of car you own. For instance:

BMW parts are significantly more expensive than Honda parts, which could affect how much collision insurance you should carry.

Remember: Any repair costs beyond the limits of your policy will be your responsibility.

7.Comprehensive Insurance

Covers damages to your car caused by theft, vandalism, or natural events (e.g., hail or falling trees). It helps replace a vehicle of equivalent value to your current car.

Important Note: Comprehensive and collision insurance cover the current market value of your vehicle, not the purchase price or loan amount. Cars depreciate the moment they leave the dealership, so over time, you may decide to drop these coverages to save money.

When to Drop Your Car Insurance

If you’re unsure about the value of your vehicle, check the Kelly Blue Book website by entering your car’s make, model, mileage, features, and location. It will give you an estimate of its trade-in or resale value.

Review your collision and comprehensive insurance costs. If these costs total more than 10% of your car’s potential payout value (vehicle value - deductible), consider dropping them.

While this research may take time, the savings can add up quickly and improve your monthly budget over time. Every financial choice you make creates long-term breathing room for your budget.

Be a Selective Shopper

Beyond implementing quick methods to save, another strategy is to switch insurance companies altogether.

Less than 25% of drivers regularly shop around for car insurance. Among those who compare options, nearly 50% find lower rates with other providers.

Why can one insurance company offer the same coverage for the same car at a much lower cost? It comes down to risk assessment. Some companies may consider you a higher risk based on your history, while others may categorize you at a lower risk.

Many drivers don’t take the time to compare insurance rates because shopping can be tedious. However, failing to explore options could be very costly. Some companies may offer “loyalty discounts,” but they often come at the cost of rate hikes later.

According to NerdWallet:

• 88% of drivers find car insurance comparisons frustrating.

• Drivers pay an average of $368 extra annually because they don’t shop around.

• Insurance rates can differ by up to 154% within the same ZIP code, saving drivers an average of 32% by switching providers.

How to Find the Best Policy for Your Needs

1.Review Your Current Policy

Before comparing options, examine your current coverage to ensure you aren’t overpaying.

2.Expand Your Search

Contact multiple agents and use online comparison tools (like NerdWallet) to find competitive rates. However, speaking directly with agents provides the most accurate pricing.

3.Ask About Discounts and Bundling

Many companies offer discounts for bundling car insurance with homeowners or renters insurance.

Shopping around and comparing multiple policies can lead to substantial savings. Insurance companies offer varied discounts and rates, so take time to explore options.

By taking these steps, you can reduce your car insurance costs, whether through increased deductibles, seeking eligible discounts, or switching providers. The savings can make a meaningful difference in your monthly budget.

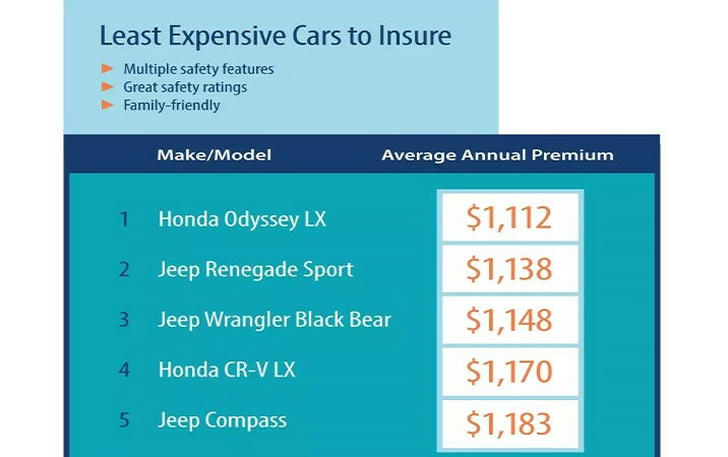

Considering a New Vehicle

Another option to reduce insurance costs is getting a new car. Insurance companies monitor specific vehicles and colors linked to higher risks. For example, high-end vehicles are more likely to be stolen, and sports cars with high horsepower are riskier. Red cars are statistically linked to more accidents. According to NerdWallet, SUVs are among the cheapest cars to insure because they’re stable, practical, and non-flashy.

If your insurance costs are too high, consider trading your current car for a safer, cheaper-to-insure option. This can reduce your premiums and improve your safety.

Conclusion

You can likely find ways to lower your car insurance costs with some effort. Compare coverage and quotes from different companies to ensure you get the best

Start by reviewing your current policy and listing your coverage and premium payments, which can usually be found on your online account dashboard. Determine if you truly need the current coverage amount. Once you know your needs, shop around to find better rates with similar coverage. If you find a better deal, check if your current insurer can match it. If not, swit