Will Home Insurance Cover a Broken Window?

When a window in your home breaks, one of the first questions you might ask is whether your home insurance policy will cover the cost of repairs or replacement. Windows are an essential part of any home, providing light, ventilation, and security. Knowing what your insurance policy covers can save you from unexpected expenses. Let’s dive deep into the details.

What Types of Window Damage Are Covered by Insurance

When it comes to broken windows, the coverage depends on the type of damage and the events that caused it. Let’s break it down:

1. Accidental Damage Coverage

Most standard home insurance policies do not include coverage for accidental damage to your windows unless you’ve added this as an extra feature. For example:

• A stray baseball shattering your living room window.

• Accidentally cracking the window during a DIY repair.

Pro Tip: Adding accidental damage coverage to your policy might be worth it, especially if you have children or live in a busy neighborhood.

2. Weather-Related Damage

Natural disasters and extreme weather are among the most common causes of window damage. Most home insurance policies cover weather-related incidents such as:

• Hailstorms: Damage from large hailstones smashing windows.

• Windstorms: Flying debris during a hurricane or tornado.

• Heavy snowfall or ice: Ice build-up causing windows to crack.

However, certain disasters like floods or earthquakes might require additional insurance policies or riders.

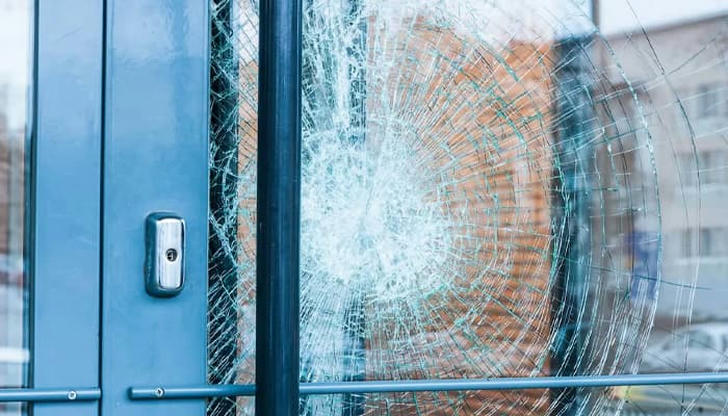

3. Vandalism or Theft

Your home insurance typically covers vandalism and theft-related window damage.

• Scenario: A burglar breaks your window to enter your home.

• Action Required: File a police report immediately as most insurance companies will require this documentation.

4. Uncovered Scenarios

Some situations are typically not covered under standard home insurance, including:

• Wear and Tear: Aging windows or minor cracks from years of use.

• Neglect: Damage that could have been avoided with proper maintenance.

How to Maximize Your Home Insurance for Window Repairs

Filing a successful claim for a broken window requires preparation and a clear understanding of your policy. Here’s how to make the most of your home insurance:

1. Review Your Policy Regularly

Stay familiar with your coverage limits, exclusions, and deductibles. Key details to check include:

• Does the policy include accidental damage?

• Are you covered for all weather-related damages?

• What are the deductible amounts for window repair claims?

2. Maintain Proper Documentation

The more evidence you can provide, the smoother the claims process. Important steps include:

• Take Photos: Capture images of the broken window from multiple angles.

• Keep Receipts: Save receipts from any repairs, replacements, or temporary fixes.

3. Consider Additional Coverage

If you live in an area prone to severe weather or have valuable, large custom windows, you might need extra protection. Options include:

• Endorsements: Added coverage for high-value windows.

• Riders: Specific protection for frequent weather incidents.

4. File Claims Properly

When filing an insurance claim for a broken window:

Contact your insurer immediately to report the damage.

Provide detailed documentation, including photos and receipts.

Follow up to ensure your claim is processed.

How Deductibles Impact Your Window Repair Claims

Every home insurance claim requires you to pay a deductible before the insurer covers the rest. For example:

• Repair Cost: $1,000

• Your Deductible: $500

• Insurance Payout: $500

In cases where the repair cost is less than your deductible, paying out-of-pocket makes more sense.

Does Liability Insurance Cover Third-Party Window Damage?

If you accidentally damage someone else’s window, your liability coverage may come to the rescue. Examples include:

• A tree from your yard falling on your neighbor’s window.

• A guest’s child breaking a window at their home while under your supervision.

Ensure you understand the liability limits of your home insurance to avoid surprises.

Conclusion

In conclusion, understanding your home insurance policy is crucial when dealing with window damage. Whether it’s storm-related, accidental, or due to vandalism, being prepared with documentation and knowing your coverage options can save time and money.