-

Home Insurance

Home InsuranceDoes Home Insurance Cover Basement Flooding?

Basement flooding is a nightmare no homeowner wants to face, but it’s a common problem that begs the question: does home insurance have your back in such situations? The answer isn’t straightforward—it depends on the cause of the flooding and the specifics of your policy. Let’s dive deeper to uncover the details.

-

Home Insurance

Home InsuranceDoes home insurance cover furnace replacement

When your furnace stops working, especially during the colder months, you might wonder, “Does my home insurance cover furnace replacement?” It’s a valid concern, as furnaces are integral to keeping your home comfortable. However, the answer isn’t straightforward—it depends on the cause of the damage and your insurance policy's terms.

-

Home Insurance

Home InsuranceDoes Home Insurance Cover Sewer Line Replacement?

Sewer line issues are a nightmare for homeowners. These problems can disrupt your daily life from leaks to blockages and rack up costly repairs. One burning question is: Does home insurance cover sewer line replacement? The answer isn’t straightforward and depends on various factors, including your policy and the cause of the damage. This guide breaks down everything you need to know, helping you understand the scope of your coverage and the best ways to protect your home.

-

Home Insurance

Home InsuranceDoes Home Insurance Cover Window Replacement?

Home insurance is a vital safeguard for your property, but when it comes to specific repairs like window replacement, things can get a little tricky. To understand the nuances of coverage, let’s dive deep into what homeowners insurance typically offers, how to file a claim and other crucial details.

-

Home Insurance

Home InsuranceDoes State Farm Home Insurance Cover Plumbing?

Plumbing problems are one of the common headaches of homeowners. From bursting pipes to slow leaks, these can lead to drastic damage if they are not monitored. You have probably signed up for a State Farm home insurance policy and are interested in finding out whether plumbing-related damages are covered. Let's explore the kinds of plumbing problems that are covered and offer you tips on preventing these issues altogether.

-

Home Insurance

Home InsuranceDoes State Farm home insurance cover siding replacement?

Typically, the replacement of siding depends on the cause of damage under State Farm home insurance. Under home insurance, damages are covered that have been caused by "covered perils." This includes events caused by storms, fires, vandalism, or falling objects. For example, should the hailstorm damage your siding, then your costs for repair or replacement will be absorbed under the policy.

-

Home Insurance

Home InsuranceHow to Start an Insurance Agency from Home

A home-based insurance agency business is very lucrative and flexible. The basic reason for starting a home-based insurance agency is to profit from a fast-growing demand for insurance services. Starting an insurance agency from home not only can save one a lot of money but also can empower him. In this blog, we will take the following steps to start a home-based insurance agency and share online marketing strategies for attracting clients and growing your business.

-

Home Insurance

Home InsuranceOnline Marketing Strategies to Attract Insurance Clients

1. Leverage Social Media

Social media would be a good avenue to reach potential clients. We would need to leverage the presence on LinkedIn, Facebook, and Instagram. Offer helpful content, client testimonials, and updates about your services to build a strong online presence and engage with your audience.

-

Home Insurance

Home InsuranceWhat Happens If You Don’t Have Home Insurance

Owning a home is a monumental milestone, but with great investment comes great responsibility. Home insurance often feels like just another bill, but it’s much more than that. Imagine the financial havoc if a natural disaster wiped out your home or a thief stripped it bare. Without home insurance, you might face these nightmares alone. Let’s explore why home insurance is indispensable and what could happen if you decide to skip it.

-

Home Insurance

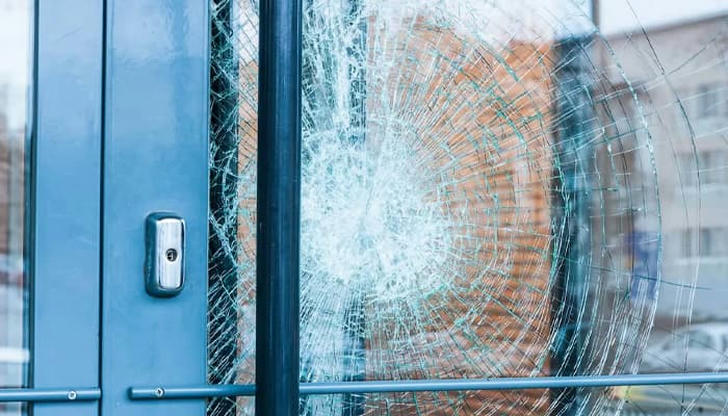

Home InsuranceWill Home Insurance Cover a Broken Window?

When a window in your home breaks, one of the first questions you might ask is whether your home insurance policy will cover the cost of repairs or replacement. Windows are an essential part of any home, providing light, ventilation, and security. Knowing what your insurance policy covers can save you from unexpected expenses. Let’s dive deep into the details.